Profit Improvement Report

Prepared for SWA

Vol. 31, No. 2

June 2022

Prospering During the Great Resignation

By Dr. Albert D. Bates

Principal, Distribution Performance Project

As every executive know, payroll costs are under serious attack. Stories abound about bonuses paid to new operating employees, extended time-off for family leave and the like. While the Covid outbreak initiated the problem, it has taken on a life of its own. The sobriquet “The Great Resignation” is an apt description.

The implications for profitability are ominous. Payroll accounts for close to two-thirds of total operating expenses for firms in every line of trade in distribution. If payroll costs rise even modestly as a percent of sales, profit will plummet.

This report examines the nature of the payroll challenge and offers some solutions. It will do so from two important perspectives:

- The Economics of the Payroll Challenge—A discussion of how even modest changes in payroll costs versus sales volume can cause profit to rise or fall.

- Managing Payroll Cost Growth—Some specific suggestions for improving payroll performance, even in a tight labor market.

The Economics of the Payroll Challenge

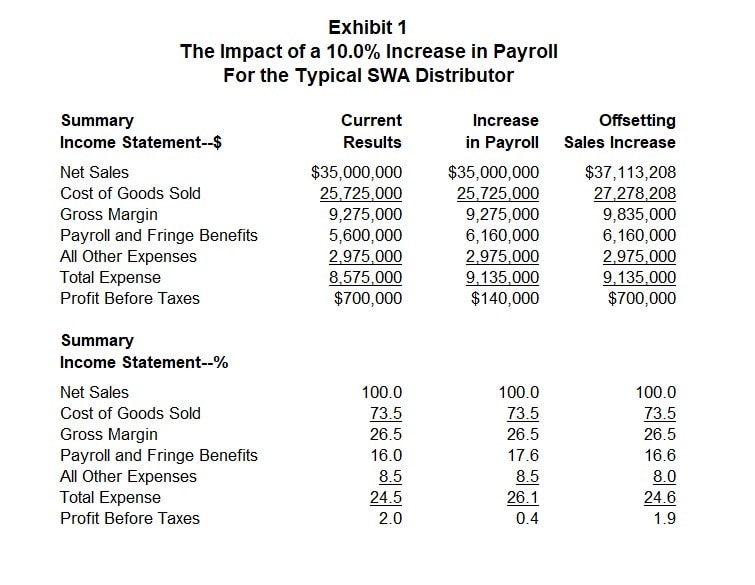

Exhibit 1 demonstrates the impact of a 10.0% increase in total payroll costs for a typical SWA member. All figures are based upon results over the last five years according to the industry’s ABR Report.

As can be seen in the first column, the typical firm generates $35.0 million in sales, operates on a gross margin of 26.5% of sales and produces a bottom-line profit of 2.0% of sales, or $700,000.

As mentioned previously, payroll is usually around two-thirds of total expenses in distribution. For the illustrative SWA member, payroll is 16.0% of sales—or 65.3% of total operating expenses.

It is important to note that payroll expense is a fully-loaded number. It includes all salaries, wages, commission and bonuses. It also includes the social costs associated with payroll, including FICA and Medicare contributions, worker’s compensation, health insurance and all retirement programs. Payroll is, quite simply, the name of the game.

The last two columns reflect the profit impact of a 10.0% increase in payroll costs. It makes no real difference if the increase is in wages or fringe benefits.

In the first column of changes, labeled Increase in Payroll, the firm absorbs the payroll costs increase and takes no offsetting actions. As can be seen, the impact is dramatic.

Profit falls from the current $700,000 to only $140,000. This represents a decline of 80.0%. Profit as a percent of sales falls to an ominous 0.4%. Clearly it is a situation that must be addressed.

The last column of numbers, labeled Offsetting Sales Increase, looks at the increase in sales required to exactly offset the dollar increase in payroll and return profit before taxes to its original level.

For the typical firm the increase is 6.0%. Depending upon management’s perspective, this can be viewed as modest or challenging. Whatever the viewpoint, it is substantially less than the 10.0% increase in payroll.

The last column is predicated on two important assumptions. The first is that the gross margin percentage does not change. The second is that non-payroll costs (All Other Expenses in the exhibit) do not increase. If the increase in payroll costs is accompanied by a serious turnover in the employee base, some of these costs such as recruiting and training will increase as well.

Offsetting the payroll increase with added sales is an admirable effort. However, many potential actions, such as adding new customers or opening and additional branch will cause a “payroll first, sales second” problem.

There is probably no way to increase sales without some increase in payroll. Ideally, though there are strategies for increasing sales with only minor increases in payroll costs.

Managing Payroll Costs Growth

Theoretically, there are numerous ways to raise sales without incurring additional payroll expense. These can include converting straight salary costs to incentive costs, using non-monetary retention efforts and the old favorite of “increasing productivity.” At present, a better approach is to rethink the firm’s transaction economics and control the pressure points there.

Assessing transactions economics involves reviewing the amount of work associated with each individual transaction. It addresses the reality that the same level of sales volume can produce very different profit levels, depending upon the workload, and associated payroll expense, required. The challenge is to be able to control that workload.

Two key factors have always been important in transaction analysis. The first is the number of line items sold per transaction. The second is the average line value. A system that measures these factors and then uses them in planning can go a long way towards actually lowering the payroll cost percentage.

The number of line items rests heavily on the degree to which add-on selling is continually reinforced throughout the firm. Over time, there is a tendency to grow tired of asking the “do you want fries with that” question. Nevertheless, the need to keep asking must be emphasized continually.

The average line item extension is by far the more important of the two factors in lowering payroll costs. Increasing this number has almost no impact on payroll other than commissions. Like everything in life, if it is the most important, it is also the most difficult.

The line extension improvement involves two very different issues. The first is to work with customers to modify, at least slightly, their buying pattern. Ideally, they would purchase the same amount of merchandise, but do so with fewer, larger orders. The second approach is to raise prices judicially where possible.

Both approaches have the potential to alienate customers, so care must be taken. They are, however, key to increasing sales without a commensurate increase in payroll costs.

Foving Forward

Payroll pressures are not likely to go away soon. Efforts to actually lower payroll costs are probably doomed. The key is to manage payroll in relation to sales via an emphasis on order economics.

About the Author:

Dr. Albert D. Bates is Principal of the Distribution Performance Project and a Senior Advisor to Benchmarking Analytics. His latest book, Breaking Down the Profit Barriers in Distribution, is available online at Amazon and Barnes & Noble. It covers concepts that every decision maker should understand.

©2022 Distribution Performance Project and Benchmarking Analytics. SWA has unlimited duplication rights for this manuscript. Further, members may duplicate this report for their internal use in any way desired. Duplication by any other organization in any manner is strictly prohibited.